New Mexico Incentives

Visit New Mexico state’s website for the latest information.

New Mexico offers tax credits and rebates for residents through several programs:

- Inflation Reduction Act Rebates for low-income New Mexicans

- Sustainable Building Tax Credit*

- Clean Cars Tax Credit*

- Solar Market Development Tax Credit

*You may be eligible for some tax credits even if you do not pay state taxes. Remember to add on Federal, electricity provider and other incentives too!

Additional Resources for Low-income New Mexicans

Inflation Reduction Act (IRA) Rebates

There are two IRA Rebate programs. In New Mexico, these are for low-income households, with incomes less than 80% of the Area Median Income or participation in certain programs. See if you qualify.

-

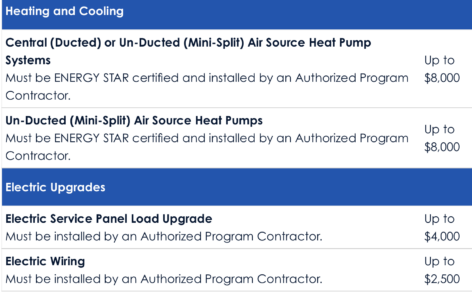

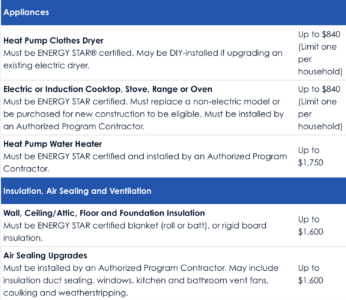

- The Home Electrification and Appliance Rebates (HEAR) offers coupons or rebates for a range of products obtained through participating retailers and/or contractors.

-

- The Home Energy Rebates (HER) will cover home energy efficiency upgrades based on lowering the overall energy use of the home.

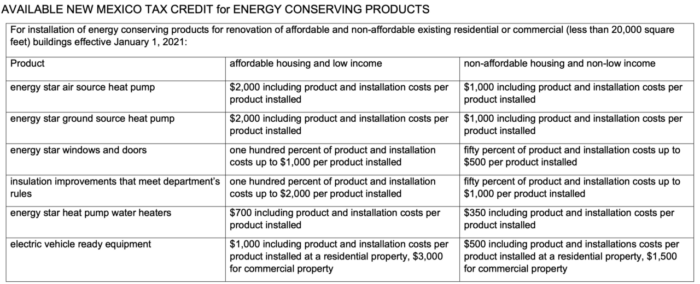

Sustainable Building Tax Credit (SBTC)

These credits are for doors, windows, air- and ground-sourced heat pumps, heat pump water heaters, insulation improvements and EV charger installation. Higher credits are given to low income residents or installations made in affordable housing. Tax credit is refundable for residents with incomes <200% of the Federal Poverty Level.

Clean Cars Tax Credit

- NM Clean Car Tax Credit website and FAQs

- Visit our Electric Vehicle and Charger webpages for tips!

Solar Market Development Tax Credit (SMDTC)

This tax credit is available to businesses and homeowners for solar equipment and installation. Solar systems installed on or after March 1, 2020 are eligible for a tax credit of 10%, up to $6,000. This is a great opportunity to lower energy bills, protect the environment, increase the value of your home, and save money at tax time!

This tax credit is available to businesses and homeowners for solar equipment and installation. Solar systems installed on or after March 1, 2020 are eligible for a tax credit of 10%, up to $6,000. This is a great opportunity to lower energy bills, protect the environment, increase the value of your home, and save money at tax time!

Solar Tax Credit Dashboard shows how much funds are available, the number of projects per county, average taxpayer annual energy cost savings and other statistics.

Solar For All for Low-Income Households

Solar for All is a U.S. Environmental Protection Agency (EPA) program designed to make solar power available to low-income households. New Mexico was awarded a $156 million to fund solar systems for households that otherwise might not be able to access this clean, renewable form of energy. The program will be available in NM May 1, 2025, unless the new US administration “claws back” funding.

Community Energy Efficiency Development (CEED) Program

(CEED) Block Grant Act was passed in 2022 to provide grants for targeted residential energy efficiency improvements in underserved communities across New Mexico.

Be on the lookout for the first batch of CEED programs implemented by these counties and municipalities.

Housing NM

Programs including it’s Home Rehabilitation, Weatherization and Veteran’s programs for low-income residents.

Programs including it’s Home Rehabilitation, Weatherization and Veteran’s programs for low-income residents.

Also check out our Resources for Low-income Residents page.

Use the SBTC to:

Use the SBTC to:

These are the tax credits for new, used and leased (min 3 year lease) vehicles, which must be purchased or leased through a dealer licensed by the New Mexico motor vehicle division, or a located on tribal land within New Mexico (e.g., Tesla).

These are the tax credits for new, used and leased (min 3 year lease) vehicles, which must be purchased or leased through a dealer licensed by the New Mexico motor vehicle division, or a located on tribal land within New Mexico (e.g., Tesla).