The state of New Mexico offers tax credits, rebates and no-cost upgrades through a variety of programs. Most, but not all, of the tax credits are refundable, meaning you do not have to owe state taxes in order to receive the tax credit. But you will have to file a tax return.

New Mexico Clean Energy Incentives for homeowners and businesses. See what you qualify for.

Tip: Sign up for their newsletter for the latest updates.

Programs

Tax Credits

-

- Sustainable Building Tax Credit

- Geothermal Ground Coupled Heat Pump Tax Credit

- Solar Market Development Tax Credit

- Clean Cars Tax Credit

Income-qualified Rebates

-

- Home Electrification and Appliance Rebates (HEAR) program rolls out point-of-sale rebates for different products in phases. You must qualify for the program on the basis of income and other factors. See if you qualify. The maximum amount of rebates one household can receive is $14,000. See the section below for more information.

- Home Energy Rebate (HER) program scheduled for April 2026 will provide rebates for select home improvement projects that lower energy use and increase efficiency.

Grants to communities for household upgrades

-

- Community Energy Efficiency Development (CEED) program awards block grants to government, tribal and community groups to improve residential energy efficiency and affordability for underserved communities across the state. These groups provide no-cost retrofits and upgrades with in select communities and across the state through Housing New Mexico. See Resources for Income-Limited Residents for more information on CEED and other programs that offer no-cost retrofits.

For state tax credits you must first apply for a Certificate of Eligibility from the Energy, Minerals and Natural Resources Department (EMNRD). Then you file this certificate with your taxes, typically in the following April. Some funds have annual caps so it is best to apply as soon as your project is completed.

Tip: Look at the list of documents and product technical requirements as you begin your project.

Tip: Each EMNRD Tax Credit webpage has a link to a very informative document with detailed instructions. Example for windows.

Sustainable Building Tax Credit

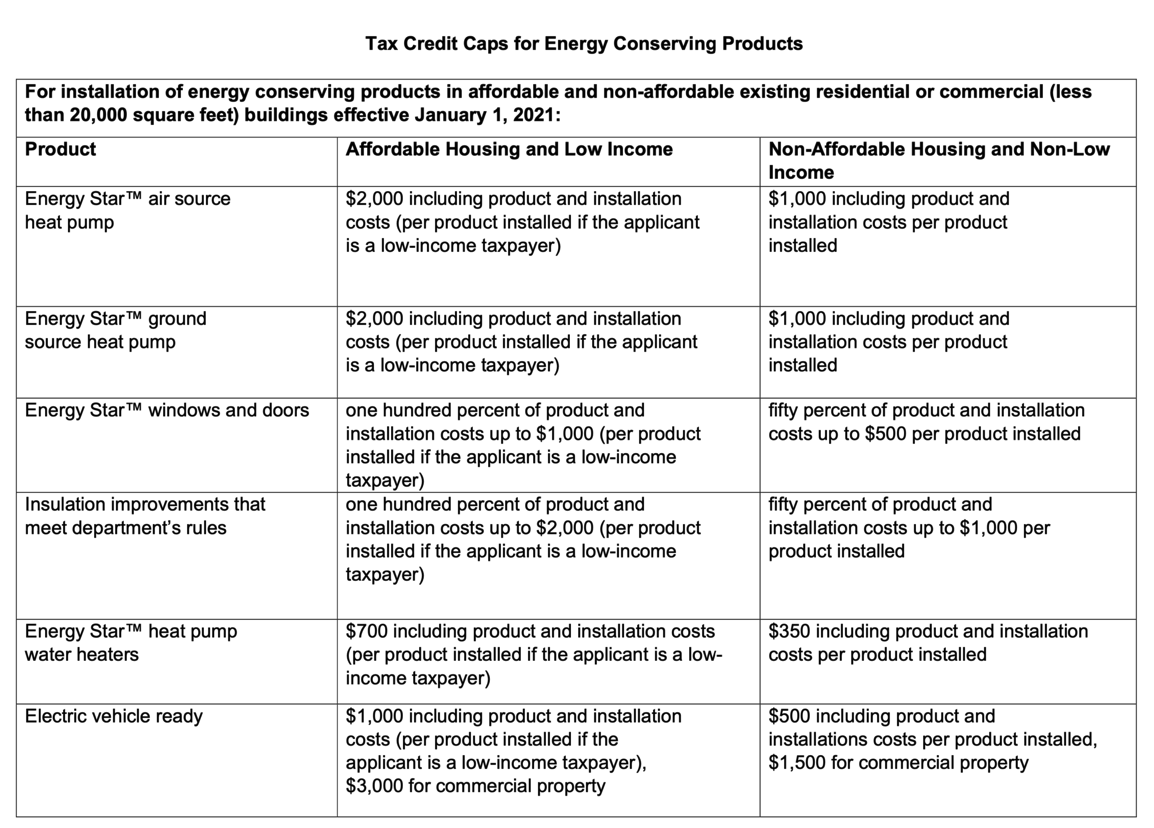

The Sustainable Building Tax Credit has several parts including new residential and commercial construction, manufactured housing, large commercial renovation and energy conserving products. This section deals with the latter, which is what most taxpayers tap for home or small business upgrades.

The Sustainable Building Tax Credit has several parts including new residential and commercial construction, manufactured housing, large commercial renovation and energy conserving products. This section deals with the latter, which is what most taxpayers tap for home or small business upgrades.

Tip: Note technical requirements of products and required documents before you begin the project. See Guides at bottom of SBTC website.

Note: This tax credit is refundable for low-income residents and non-refundable to higher income households.

WHO: Individual homeowners and business taxpayers (including landlords).

WHAT: Energy Star doors and windows, air- and ground-sourced heat pumps, heat pump water heaters, insulation improvements and EV charger installations.

HOW: Note technical requirements of products and required documents before you begin the project. (See Application Guides at bottom of this SBTC page). Soon after the project is done, collect required documents and apply here for a “2021 Sustainable Building Tax Credit” certificate. File the certificate with your tax return. Filing instructions from NM Taxation and Revenue.

TAX CREDIT: The Sustainable Building Tax Credit passed in 2021 is refundable for qualifying low-income residents and non-refundable for everyone else. Low Income is <200% of the Federal poverty level (2026 levels), which depend on household size.If you are a low-income taxpayer, request the refund on Schedule PIT-RC of your return. For higher-income households, the non-refundable tax credit can be carried over to the next year. Use Schedule PIT-CR.

Clean Cars Tax Credit – thru 2029

The Clean Cars Tax Credit is a refundable tax credit for the purchase or lease (>3 years) of new and used EVs and plug-in hybrids. It also offers a $400 tax credit for Level 1-3 chargers.

To receive the credit you must apply to EMNRD for a Certificate of Eligibility, which you later file with your taxes (typically in April) to receive the tax credit. Dealers are allowed to take your tax credit in exchange for an immediate price discount, but not all dealers have signed up to do this.

Important pages

Documents you need to apply for tax credit certificate

Apply here for Certificate

New Mexico state Clean Cars Incentives page

More detailed instructions

350NM Electrify New Mexico EV and EV Chargers page-more general info and additional sources of rebates

Clean Cars

WHO: New Mexico taxpayer even if you owe $0 New Mexico taxes

HOW: Purchase or lease at least 3 years from a dealer licensed in New Mexico or located on tribal land. The car can be delivered or picked up from another state as long as you purchased it from a New Mexico dealer and register it in this state.

WHAT: New or used battery electric vehicle (BEV), plug-in hybrid electric vehicle (PHEV), or hydrogen fuel-cell electric vehicle (FCEV)

Maximum base manufacturer suggest retail price allowed (before destination charges and taxes):

New – $55,000.

Used – $25,000

Important used requirements:

*Model year must be at least 2 years earlier than current year, e.g., in 2026, used model years 2024 and older are eligible.

*Used vehicle must be certified by dealer and have a dealer-provided warranty of at least a one-year against defects and repairs. You may have to pay separately for the warranty.

WHEN: Purchased May 15, 2024 through December 31, 2029

TAX CREDIT: Refundable. Even if you owe no taxes you will receive the tax credit as a refund on a tax return.

EV Chargers

EV Chargers

WHAT: Charging unit designed for charging electric vehicles, plug-in hybrid electric vehicles, or fuel cell vehicles

DETAIL: Applications for the state tax credit shall be made no later than one year from the date the charging unit is purchased or, if the unit is installed, the installation date.

Note: The Sustainable Building Tax Credit also has a charger rebate of $500. You can only use one.

More info from EMNRD

Geothermal Ground Coupled Heat Pump Tax Credit

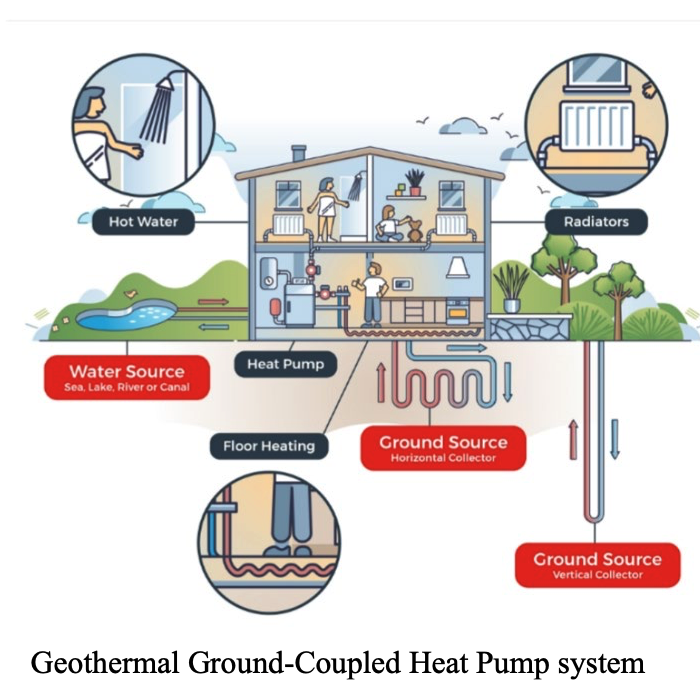

A ground-coupled heat pump heats and cools your building and warms water. It works like an air source heat pump but moves heat into and out of the house using the more stable temperature of the earth than the fluctuating temperatures of air. It circulates a fluid through buried pipes to exchange heat with the soil. These heat pumps are typically more efficient than air-source heat pumps but are usually more expensive to install due to the need to bury pipes in the ground.

WHO: New Mexico property owners (residential or commercial)

WHO: New Mexico property owners (residential or commercial)

WHEN: Products installed between May 15, 2024, and December 31, 2034

WHERE: owned property of residences, businesses, or agricultural enterprises located in New Mexico

WHAT: geothermal ground-coupled heat pump system with a Coefficient of Performance (COP) of 3.4 or higher and Energy Efficiency Ratio (EER) of 16 or greater

TAX CREDIT: refundable income tax credit of up to 30% of the purchase and installation costs up to $9,000 dollars. Credit year is based on the date the local building authority certifies a successful inspection. There is a smaller tax credit for ground based heat pumps in the Sustainable Building Tax Credit.

REQUIRED DOCUMENTS TO SUBMIT TO EMNRD:

• Proof of property ownership (e.g., deed, mortgage, or tax bill)

• Itemized invoice with product and labor costs,

• Manufacturer documentation (model and performance ratings)

• Installer certification (IGSHPA or equivalent)

• Final inspection report

• System design schematic and technical specifications

More info: System must be fully functional and in use. Certified installer. There are annual caps.

Solar Market Development Tax Credit (SMDTC) – thru 2031

*Mimi Stewart has introduced a bill in the 2026 session that will increase the state solar tax credit to 30% up to $15,000. Tell your reps to vote Yes!

Installing solar is a great opportunity to lower energy bills, protect the environment, increase the value of your home, and save money at tax time! If you have a bad or shaded roof, rent or otherwise do not want to purchase a solar system, explore Community Solar and other options on our Solar and Batteries page.

Installing solar is a great opportunity to lower energy bills, protect the environment, increase the value of your home, and save money at tax time! If you have a bad or shaded roof, rent or otherwise do not want to purchase a solar system, explore Community Solar and other options on our Solar and Batteries page.

Useful webpages

EMNRD Solar Market Development Tax Credit

Detailed User Guide

Solar Market Development Tax Credit Program Dashboard

WHO: Individual taxpayers, corporation or agricultural enterprise

WHAT: Solar electric equipment and installation on property owned by you or on some leaseholds for tribes or pueblos. Contact ECAM for instructions on how to claim costs related to a solar thermal system.

HOW: Apply for a certificate of eligibility within 12 months of installation. (Website gives this example tho – 2025 install application deadline is Dec. 31, 2026). Your contractor should provide you with most or all of the Required Documents. Submit certificate, Form TRD-41406, New Solar Market Development Tax Credit Claim and a Schedule CR to claim the tax credit when you file your state taxes.

WHEN: Installed on or after March 1, 2020 through December 31, 2031. The fund year of the solar energy system is determined by the date the building code authority certifies a successful inspection of the solar system.

TAX CREDIT: 10% up to $6,000

How can you benefit?

- Lower energy bills. The estimated average annual energy cost savings for a New Mexico taxpayer is $1,660 (based on a statewide average of $0.12 per kWh).

- Increase home value. According to a large scale study by the Department of Energy’s Lawrence Berkley Laboratory, home buyers are consistently willing to pay more for homes with solar energy systems. Despite increased home value, New Mexico does not add this value to your property taxes.